Customized financial solutions crafted by experts to perfectly align with your

specific needs and goals.

Since 2014, we’ve been at the forefront of India’s tax e-filing evolution, transforming the journey of clients by taking care of Holistic Financial Health, not just e-filing

Holistic Financial Health

Taking care of Holistic Financial Health of Clients.

Tax Savvy

Leading the way in e-filing along with Holistic financial Health since 2014, recognized as India’s largest e-filing company.

Tax-Efficient Salary Optimization

Streamlined Salary Setup: Design your salary to reduce taxes and boost wealth.

Accurate Compliance

Ensuring adherence to all relevant tax laws, filing returns on time, and maintaining precise records which minimizes the risk of penalties and legal issues

Competitive Pricing with No Hidden Costs – Know What You’re Paying For -:

Happy Words From Our clients:

"TaxMittar made the entire process of filing my taxes effortless and efficient. Their team provided expert advice on complex tax issues, ensuring everything was handled smoothly. "

Alison Burgas

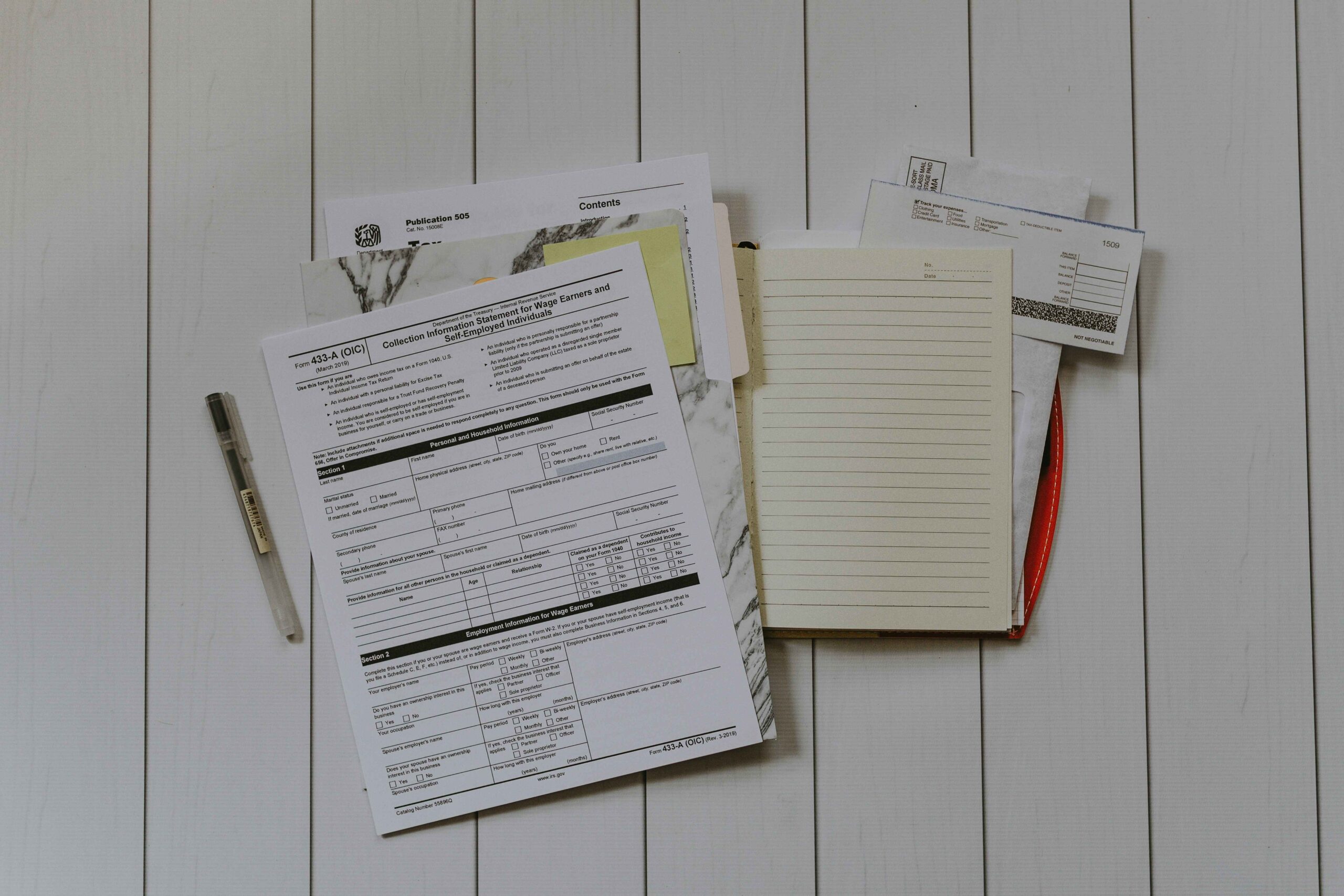

TaxMitar is an online tax filing platform authorized by the Income Tax Department as an ERI (E-Return Intermediary). We provide a wide range of tax filing and financial wellness services to individuals and businesses.

E-Filing is the process of electronically submitting your Income Tax Return (ITR) to the Income Tax Department. It is faster, more convenient, and secure compared to traditional paper filing.

Any individual or entity whose income exceeds the basic exemption limit set by the Income Tax Department is required to file an ITR. This includes salaried employees, self-employed individuals, freelancers, and businesses.

Filing your ITR online with TaxMitar is simple. Sign up on our platform, provide the necessary details and documents, and follow our guided steps to complete your filing. We also offer assistance to ensure a smooth process.

If you miss the due date, you can still file a belated return. However, late filing may attract penalties and interest charges on any unpaid taxes. It’s important to file before the deadline to avoid these issues.

Penalties for not filing an ITR on time include a late filing fee of up to ₹10,000, along with interest on unpaid taxes. In certain cases, failure to file can lead to further legal consequences.

“Learn More About Our Services – Contact Us Today for a Consultation.”